Associate Lease

With many years of experience dealing with Associate Leases, as well as being a SmartSalary recommended financial adviser, Sheridan and Associates will assist you from the very beginning through to implementation and renewal of your Associate Leases. Our existing clients are typically employees of :

- The Department of Defence

- John Holland Group

- Santos Mining

- Revlon

- GPT Group

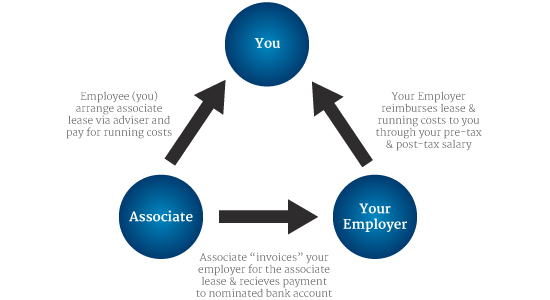

An Associate Lease is an effective income splitting strategy. It functions by making payments to an associate of the employee (whether it be a spouse, partner, relative, family company or family trust) for the use of their car. The associate declares the lease payments they receive as income and are taxed at their marginal rate of tax. The income, however, is reduced by the amount of depreciation on the vehicle and any 'interest only' costs of car finance.

As part of packaging a vehicle, you can package all associated running costs such as fuel, insurance, registration and servicing. These expenses are typically paid for with Post-Tax dollars to offset Fringe Benefits Tax (FBT).

For detailed information please view Associate Lease Arrangement Description (PDF).

For detailed information please view Associate Lease Benefit Profile Summary (PDF).

Information, advice and services related to Salary Packaging is provided by Sheridan & Associates independently of Infocus Securities Australia Pty Ltd which is not responsible for provision of this Information, advice or services.